*Update: Since this article was first published in October 2023, Sentoo has continued to evolve. While our roots are in Account-to-Account payments, we’ve expanded our platform to also include additional payment methods through our gateway—such as credit card (Visa and Mastercard) and iDEAL. This allows merchants to offer even more flexibility to their customers, while keeping the same seamless, local payment experience you expect from Sentoo.

If you're selling online, you need a way to accept online payments. Understanding how e-commerce payment processing works is crucial to a successful online business. There are some key considerations: What payment options can you give your customers? Or are you selling through a custom online store or an e-commerce platform like WooCommerce or Shopify? Today, there are lots of platforms to help you build your e-commerce website. Some require a lot of technical expertise, while others don't. At the same time, the Caribbean online payment landscape is even more complex because e-commerce platforms often do not work with local payments.

The e-commerce and payment processing concepts are hard to navigate, especially in our region. If you do not yet know how to distinguish a payment method from a gateway or a processor, we're here to break it down for you.

Online Payment methods

To understand e-commerce payment processing, let’s first start with reviewing different payment methods since getting paid is at the core of your e-business. An online payment method is how customers pay for a service or product. There are several options:

| Digital Wallets: | Digital wallets allow customers to pay when using a device, so they don't need to carry cards around. Popular wallets include Google Pay, Apple Pay, Zelle, or Venmo, which lets them send and receive money. The wallet must be sufficiently funded using a bank transfer or debit/credit card. Also, payments might be limited when exceeding a certain amount. |

|

Account-to Account payments: |

Also known as A2A, these real-time payments are direct money transfers from one bank account to another. In 2022, A2A payments accounted for US$525 billion in global e-commerce value, at an expected annual growth rate of 13% through 2026. Some of the most well-known A2A payment methods are iDEAL in the Netherlands and Pix in Brazil. |

| Debit/Credit cards: | These card payments are connected to a cardholder's bank account. A debit card deducts money directly from the customer's accounts, while credit cards allow them to pay back money later. |

| Alternative methods: | Though not technically a payment method, Buy Now, Pay Later, or BNPL solutions are more precisely a type of short-term financing. Services provided by, for example, Afterpay and Klarna are popular for their flexible way of allowing customers to pay for purchases in installments. |

So, where does Sentoo fit in as a payment method? Sentoo is an Account-to-Account payment method (A2A), meaning you use your bank account to pay online. At checkout, rather than entering payment information, you're redirected to the online banking portal to approve the payment. In our previous blog, we've already outlined this in more detail. One of the most significant advantages of Sentoo over other payment methods is the instant settlement of the total payment amount. In other words, funds are instantly settled in the merchant's bank account, and no fees are deducted from the settled amount. These fees are invoiced and collected through direct debit at the end of the billing period.

Furthermore, the payments are directly processed in the bank environment, which means that A2A payment methods such as Sentoo use the bank's strong customer authentication. This multi-factor authentication greatly increases security. Another great benefit of A2A is that no sensitive payment details are ever shared and kept safe within the bank.

In any case, your payment methods should reflect how your customers want to pay and the available options in your region.

Payment gateway vs. Payment processor

Now that you know what payment methods are available, it's time to examine the key components of payment processing. While the technical inner workings are complex, it's easier to know at least how to define these core elements:

- Payment gateway: A go-between or connection that links the shopping cart on the website to the payment processor. Some call it a metaphorical cash register that allows you to accept customer payments. Every merchant needs a payment gateway to process online customer transactions.

- Payment processor: A company that manages the financial transaction and deposits the payment in the merchant's bank account. The processor also validates the payment by verifying if the customers have the funds.

Choosing the right payment gateway and processor is particularly important in our Caribbean region. Some gateways don't work for local businesses because most international processors can't deposit funds in our Caribbean bank accounts. How does this apply to Sentoo? In our case, Sentoo is integrated directly with our local banks to facilitate real-time local payments between the customer's bank account and the merchant's bank account. The local bank acts as the payment processor since they process the payment in their secured bank environment.

How do payment methods, gateways, and processors all work together?

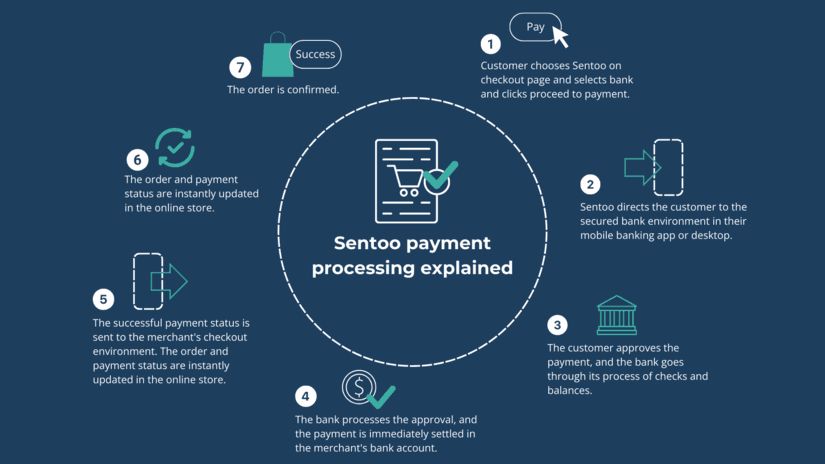

Now that you know the essential elements of e-commerce payment processing, let's look at how it all works together in the case of Sentoo. It might seem like a lot of steps, but remember that the whole process takes place in a few seconds.

- Customers choose Sentoo as the payment method and select their bank at checkout.

- Sentoo directs the customer to the secured bank environment in their mobile banking app or desktop.

- The customer approves the payment, and the bank goes through its process of checks and balances.

- The bank processes the approval, and the payment is immediately settled in the merchant's bank account.

- The successful payment status is sent to the merchant's checkout environment.

- The order and payment status are instantly updated in the online store.

- The order is confirmed.

E-commerce payment processing

There you have it. Knowing the whole concept of payment processing and what's available to you makes you more equipped to grow your online business. Take some time to research your options, compare pricing, and learn what's compatible with your business on the island. In the end, what's essential in online payments is that you choose accessible and secure options for both you and your local customers.

If you're interested in growing your e-commerce ambitions, Sentoo could be your ideal local online payment method. Learn more about Sentoo here or explore your options with us today!