Getting started

Sentoo is available at participating merchants in Aruba, Bonaire, Curaçao, Saba, St. Eustatius, and St. Maarten. Look for the Sentoo checkout button or our logo on a QR code or Payment link. Check out this page for the complete Merchant list.

Customers do not need to create an account to use Sentoo. No registration is required, nor do you have to download an app. Simply select Sentoo at checkout, scan our QR code, click on our payment link, and follow simple steps to authorize the payment.

Sentoo payments are done using the mobile banking app or the online banking environment of your own bank. However, all payment details, such as receiver, amount, and description, are pre-filled automatically, and you instantly know if your Sentoo payment succeeded. This also means that the company will receive your payment confirmation within seconds.

Sentoo payments can only be done using bank accounts of participating local banks in the Dutch Caribbean.

Sentoo does not charge any costs to customers. However, online banking fees may apply depending on your bank.

Making payments

Sentoo is available with Aruba Bank, Banco di Caribe, CMB, MCB Bonaire, MCB Curaçao, Orco Bank, and WIB. The bank options will be shown depending on the merchant's available bank accounts. We are working hard to add more banks to Sentoo. As soon as we can publicly announce new partnerships, we will do so through our social media and our mailing list.

If you are interested in keeping up to date with your specific bank, visit our sign-up page.

The maximum payment amount depends on your bank’s digital daily limit for online transactions. This limit is set by your bank and may vary depending on your account type and settings. If you’re unsure about your limit, we recommend checking your online banking app or contacting your bank for details.

On the merchant's behalf, your checkout payment is transferred to a ‘derdengeldenrekening’, a third-party escrow account handled by the Sentoo Escrow Foundation. That is why you will see this name on your statement.

Sentoo does not have access to your funds or bank account.

You authorize every transaction and transfer the money to the merchant like a regular bank transfer. The money is transferred directly from your bank account to the merchant's bank account. A merchant can choose our Sentoo Escrow Foundation. In that case, your money transfers directly to our authorized third-party escrow account (derdengeldenrekening), which is handled by the Sentoo Escrow Foundation on behalf of the merchant.

It's possible that you're not being redirected to your online banking app after choosing your bank for a few reasons:

- Ensure your online banking app is up-to-date.

- Verify if your default browser is set to open links in the app and NOT in the browser.

- If you have ad-blocking software or third-party related apps installed, these could impact the redirection process. Temporarily disable them to troubleshoot the issue.

- If you use Safari, try clearing 'History and Website Data' helps (Settings > Apps -> Safari).

If you have complied with these requirements and you're still not being redirected, please contact Support.

* this applies to all MCB, CMB and WIB business users.

Business Online Banking users with End Users created before the launch of Sentoo in November 2023, need to follow the steps below to enable Sentoo Payments:

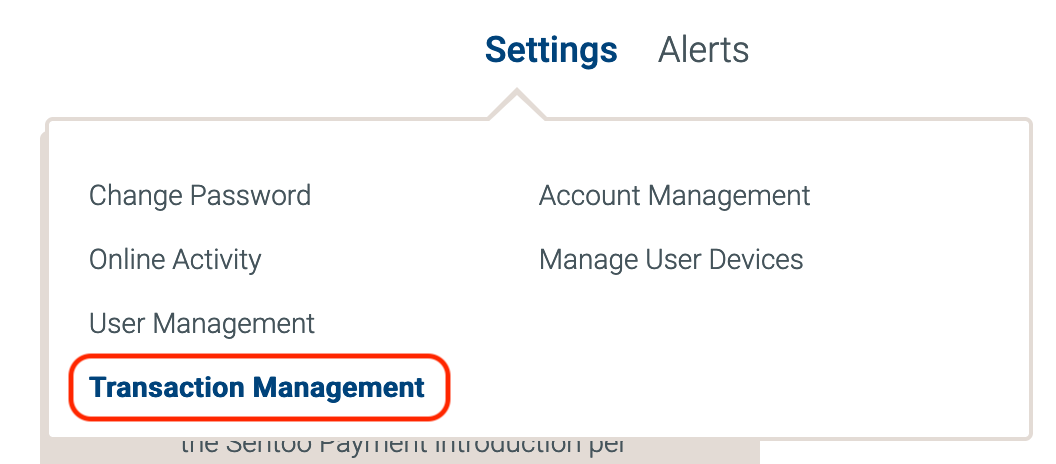

1. Open the Online Banking website and login with the Master User. From the Settings menu, select Transaction Management and select the first End User.

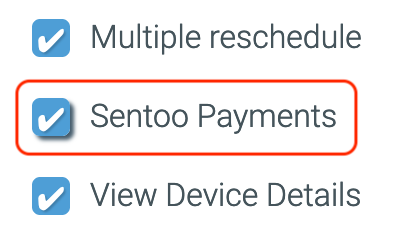

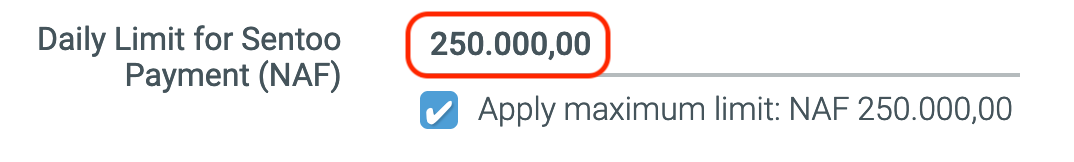

2a. For a Maker & Authorizer user, check the "Sentoo Payments" checkbox and enter a daily limit for Sentoo Payments and save the changes.

2b. For a Maker user, check the "Sentoo Payments" checkbox and save the changes.

2c. For an Authorizer user, enter a daily limit for Sentoo Payments and save the changes.

The next step only applies to Authorizer and Maker & Authorizer users. For a Maker user, you can skip this step.

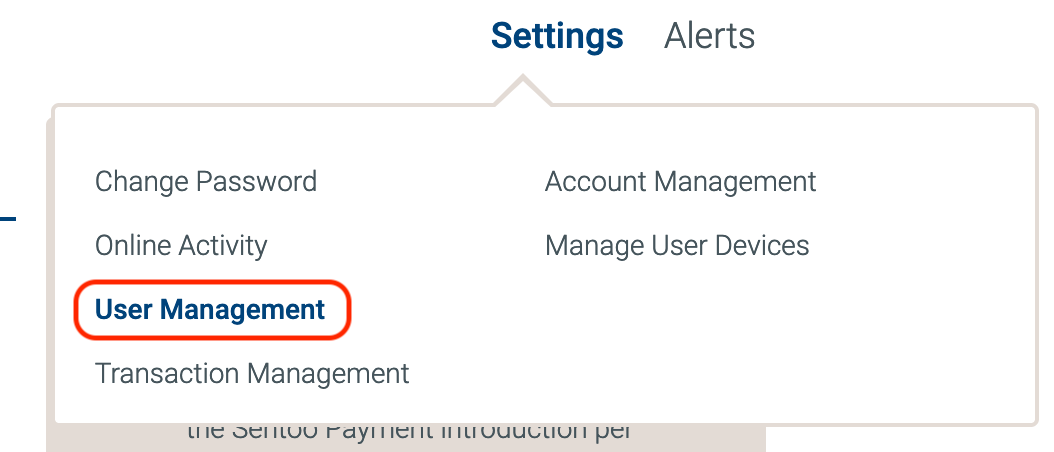

3a. From the Settings menu, select User Management and edit the first End User by clicking the pencil icon next to the full name.

3b. Under the "Business Multi-User" and under the "Business Multi-User for Apps" section, set a limit for Sentoo Payments and save the changes.

Enable these settings for all your End Users.

Problem with payments

Please contact the merchant directly and provide them with the Sentoo transaction ID or a screenshot of your bank statement.

- Caribbean Ticketshop: Email

- Digicel: Email or call 145

- ENNIA: Contact page form

- Flow: Support form or call 9363

- For other merchants, please check their websites.

If your problem is not resolved within 3 business days, please contact us.

Please note that Sentoo does not have access to your funds or bank account. The money transfers directly from your bank account to the merchant's bank account.

For questions about a specific Sentoo payment, you can start by contacting the company that you paid. You can contact Sentoo directly through the support page if they cannot answer the question.

Please get in touch with the company you’re trying to pay to check whether they have received a double payment and request them to refund the overpaid amount. If the company did not receive the amount, please get in touch with your bank. Your bank can help you further and find out the payment status. Having the Sentoo transaction number of the payment from your account statement at hand can be useful if your bank provides this.

Please contact the company you are trying to pay. They have our emergency contact information to resolve issues as soon as possible.

* this applies to all MCB, CMB and WIB business users.

If you are having difficulty verifying payment and receive the error message "The verifier cannot sign the transaction," please confirm with the master user that you have the necessary authorizer permission in the setting.

Already have permission?

Ensure the “Sentoo Payments” limit is appropriately set. If it's not set or the limit is insufficient, please make the necessary adjustments. For more info, read the MCB instructions.

* this applies to all MCB, CMB and WIB users.

If you receive the error message, it's best to fully close the MCB app. Then go back to the Sentoo payment screen and restart the payment.

Privacy & Security

At Sentoo, we value your safety and the privacy of your data. Sentoo is based on internet- and mobile banking of your own bank. Making an online payment with Sentoo is safe. The transaction takes place in two steps:

- Identification and authentication of the user within online banking. This is done through multi-factor authentication provided by the bank, with either a fingerprint, facial recognition, token, or e-pass.

- Authorization. The user grants permission for the transaction using the bank’s multi-factor authentication such as fingerprint, facial recognition, token, or e-pass.

Sentoo makes the security of your payment our highest priority. Sentoo saves as little data information as possible. We do not receive personal payment information from customers and encrypt the required payment information.