About Sentoo

With Sentoo, you can offer your customers a safe and convenient way of making local online payments. If you want to get started, you must close a merchant Agreement with Sentoo. The minimum requirements for Sentoo are that you are registered with the Chamber of Commerce and have a business bank account at one or more of our participating banks. Sentoo will provide you with the information required for the technical integration.

Any business or organization that needs to collect payments can use Sentoo. Whether you are a small online webshop or a large Tax Office, our affordable pricing makes Sentoo the best option out there.

No, your customers do not need a credit card. The payments are processed by local banks directly on their online banking systems, the only thing your customers need is a local bank account with online banking access.

Sentoo is a payment method that lets merchants receive local online payments on bank accounts from customers’ local bank accounts. Your customers pay using their own familiar online or mobile banking environment quickly and securely. Sentoo is a convenient and ideal way of receiving local online payments.

* this applies to all MCB, CMB and WIB business users.

Business Online Banking users with End Users created before the launch of Sentoo in November 2023, need to follow the steps below to enable Sentoo Payments:

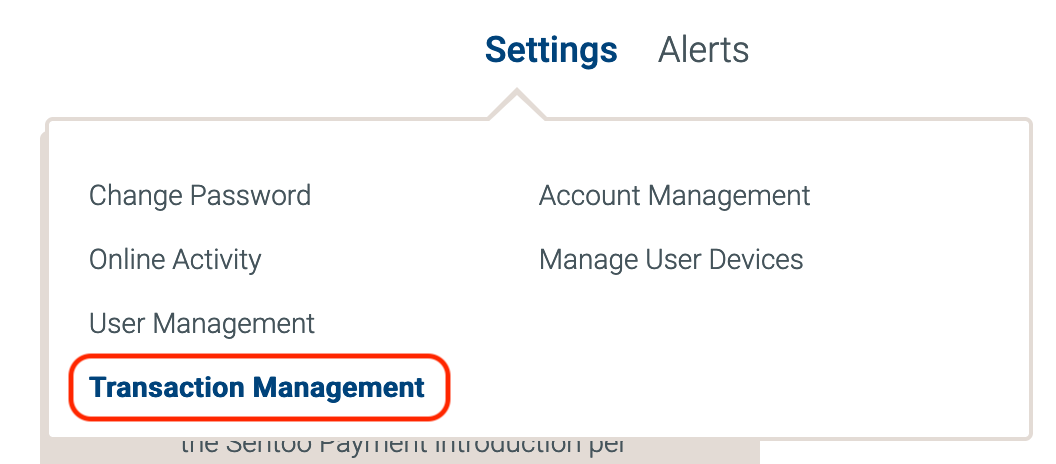

1. Open the Online Banking website and login with the Master User. From the Settings menu, select Transaction Management and select the first End User.

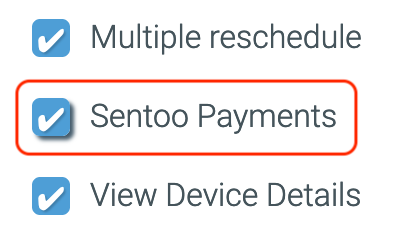

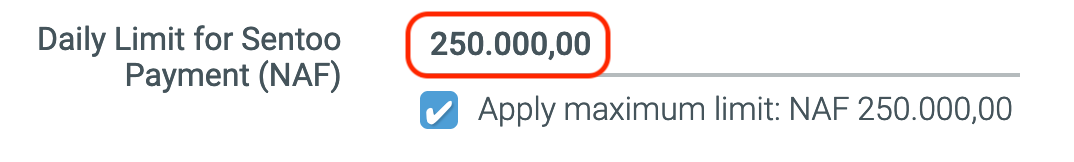

2a. For a Maker & Authorizer user, check the "Sentoo Payments" checkbox and enter a daily limit for Sentoo Payments and save the changes.

2b. For a Maker user, check the "Sentoo Payments" checkbox and save the changes.

2c. For an Authorizer user, enter a daily limit for Sentoo Payments and save the changes.

The next step only applies to Authorizer and Maker & Authorizer users. For a Maker user, you can skip this step.

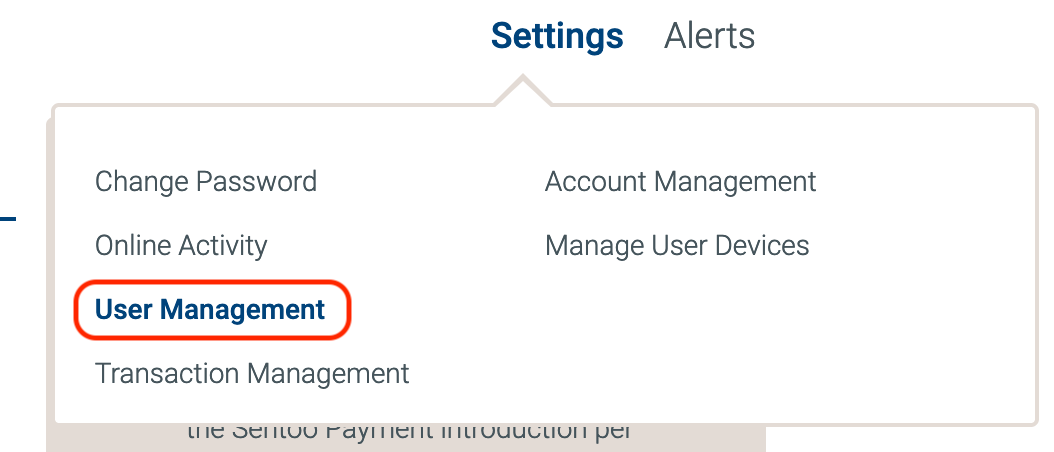

3a. From the Settings menu, select User Management and edit the first End User by clicking the pencil icon next to the full name.

3b. Under the "Business Multi-User" and under the "Business Multi-User for Apps" section, set a limit for Sentoo Payments and save the changes.

Enable these settings for all your End Users.

SentooGo

Yes, you can. It is possible to add multiple users and devices to one account. Please get in touch with us to help you set up SentooGo on additional phones.

The SentooGo app is compatible with Android and iOS (Apple) smartphones. The model must be NFC-enabled and have a camera.

SentooGo accepts local bank transfers with Sentoo. The available banks differentiate per island. Find out more about available banks. Soon, Visa and Mastercard will also be available.

SentooGo directly integrates with local banks and credit card providers to ensure secure payments. Sentoo is based on your bank's internet and mobile banking and uses the bank’s verification process. Our credit card security levels also comply with Visa and Mastercard standards.

Contact Sentoo to create a Sentoo Merchant account and get started. Sentoo will provide you with the softPOS. You can reach us at support@sentoo.io.

Receiving Sentoo payments

Sentoo offers a Merchant portal where you can log in and obtain the status of a specific payment. Here you can view the status of all your Sentoo payments.

Sentoo does not have access to your funds or business bank account.

Every transaction is authorized by your customer and transferred like a regular bank transfer. The money is transferred directly from the customer's bank account to your business' bank account.

After a successful transaction, the funds will be immediately available in your account.

When the customer authorizes a payment in their online banking environment, you will instantly receive a confirmation from Sentoo.

Integrate

When integrating with Sentoo, your developers will receive:

Merchant key for authentication

- Access to our REST API documentation

- Open API v3 / Swagger development kit with executable test API requests

- Connection to our secured integration environment

Sentoo integrates seamlessly with WooCommerce. With Sentoo's easy-to-install WooCommerce plugin, you'll be up and running in no time, securely receiving online payments from your customers via your website. Get started now!

By integrating Sentoo with your Shopify website, you can expect a streamlined online payment process, more transactions, and a user-friendly experience for both you and your customers. To get started, please contact Sentoo to sign up your business. You can choose from different payment methods such as Sentoo Pay by Bank, card payments, or iDEAL. Get started now.

We've got you covered! Sentoo has a plugin available for Sylius e-commerce platforms. Once you successfully install our Sylius plugin, customers can easily select Sentoo as a payment option on your website and make payments effortlessly. Sentoo helps you to start receiving local online payments fast & securely. Get started now!

Just follow the steps below:

- Complete your details on our online form and receive the developer package.

- Start integrating with our APIs on our integration environment for testing.

- We will then configure the various bank accounts for your organization.

- Launch the Sentoo payment method and start accepting local payments.

After you fill out the contact form, we will get in touch with you and send the developers’ documentation.

Absolutely! Sentoo provides an easy-to-use REST API, which is easily integrated with your webshop, invoicing module or online portal.

Sentoo integrates with several e-commerce platforms. We are continuously expanding our integration offerings with platforms such as Magento, Wix, and Shopware to ensure that every business can easily receive local online payments through their chosen e-commerce platform. If you want to stay updated with new plugins and/or add-ons, please subscribe to our Newsletter. To inquire about the possibility of integration with your platform or to express your interest, please Contact Support.

Pricing

The fee for Sentoo's standard pricing (A2A) is calculated on successful transactions processed by connected banks. The fee is based on 1% of the payment amount with a max of $1.50 per transaction. This means that large amounts will never cost you more than $1.50. Please review information on our pricing here or contact us.

You are billed at the end of each month for the Sentoo transactions successfully processed during that month. The invoice will be in local currency, with the option to pay via Sentoo.

Fees for additional plans or features consist of a variable component, which is determined by the type of feature and our Sentoo standard pricing (A2A) or card pricing (Visa/Mastercard). For a more detailed explanation of our fees, please visit our pricing page here.

Sentoo’s card payments fee consists of 3 components:

- Sentoo’s gateway fee ($0.27 - $0.48)

- Card processing fee 0.25% - 0.75% (plus your bank's MDR fee)

- Monthly description starting at $20

There will also be a one-time set-up fee. Want to know more about how our pricing works? Contact us.

Security & Privacy

Sentoo values your safety and the privacy of your data. For this reason, Sentoo takes several precautionary measures:

- Sentoo complies with the latest industry standards and quality requirements.

- No personally identifiable data is stored, and sensitive database fields are encrypted.

- Sentoo constantly updates and monitors the platform to maintain the expected security level.

- The traffic is TLS-encrypted, and the network and APIs are regularly pen-tested.

- Banks and third-party security auditors perform regular audits.

Sentoo saves as little data information as possible, sensitive database fields are extra encrypted, and Sentoo does not receive personal payment information from the customers. Sentoo uses Plausible, an independent analytics tool that does not store personal information for our analytics.

Card payments

Credit cards are a popular payment method that provides customers with a line of credit. They can pay back the amount in full or in installments by the end of the month. Debit cards are similar, except funds are debited directly from the customer’s debit account. The leading credit and debit card brands worldwide are Visa and Mastercard.

Credit and debit card payments are the quickest and easiest way to accept payments from customers globally. Card payments also offer value-added services such as fraud protection and 3D Secure, which can significantly benefit your business. Our onboarding process is swift, which means you can be up and running quickly.

At Sentoo, businesses can accept credit and debit cards in many ways:

- Integrations with E-commerce platforms such as WooCommerce, Wix, Odoo, Magento, and Shopify.

- API: use our API to create easy and seamless payments with QR codes and payment links.

- Manual: use our stand-alone payment screen with QR codes and payment links.

Contact Sentoo to get started with card payments. We’ll help you get set up with your merchant card account at the bank. Reach out to us at support@sentoo.io.

Credit and debit card fees are accumulated at different stages of payment processing. The fees consist of:

- One-time setup fee – fees vary per acquiring bank

- Card scheme and Merchant Discount Rate (MDR) fees vary per card processor and acquiring bank

- Sentoo gateway fee - $0.27 - $0.48

Sentoo provides built-in payer authentication so merchants can fully utilize 3D Secure, an extra layer of protection. Our security levels comply with Visa and Mastercard standards.